MANAGING DEBT THROUGH SERVICE—

The class of 2013 graduated with diplomas in hand and $35,200 on average in college-related debt, according to CNN Money. Student loans from the government compose the majority of this debt at around $26,000.

Standard monthly repayment schedules can drag on for 15 years or longer, depending on a graduate’s income and their monthly payments. Additionally, student loans can’t be forgiven in the case of declared bankruptcy.

For those who may struggle with their payments, or who want to pay off their loans quicker, graduates can earn money towards their student loans by volunteering. SponserChange. org connects sponsors, non-profit organizations and skilled volunteers with student loan debt. If selected, the volunteer, or change agent, will receive a $1,000 direct payment on their student loans when the project is complete. Change agents must be college graduates with evidence of volunteer experience to apply. Zerobound.com works on a similar model. It connects volunteers with sponsors, but volunteers must crowdfund for their own campaign. Volunteers choose a monetary goal, and sponsors (who can consist of anyone from corporations to family members) donate to the campaign. Zerobound directly transfers the money earned towards student loan debt.

Zerobound is still in its beta version, and future volunteers will be put on a waiting list.

Students who wish to attend graduate school may amass an even greater sum of debt. According to TIME magazine, graduate students make up around 40 percent of the total $1.2 trillion in student loan debt, even though they only contribute to 14 percent of university enrollment. For these graduates, student loan forgiveness can settle enormous debt.

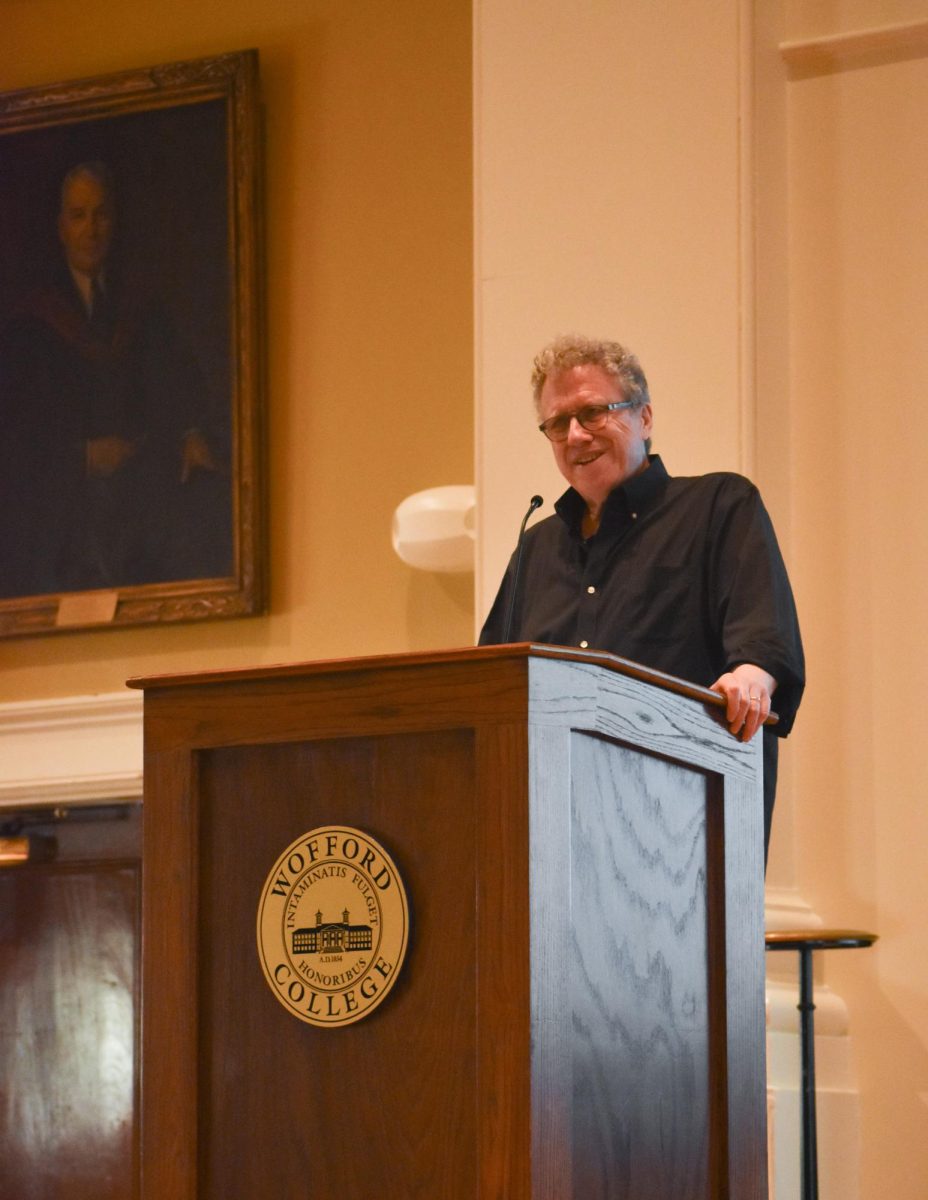

“There are two parts to loan forgiveness,” says Wofford’s Dr. Jeremy Henkel. “Income based repayment, or IBR, and Public Service Loan Forgiveness, PSLF.” IBR is a plan in which students pay no more than 10 percent of their income towards student loans, and all debt beyond 20 years of payment is forgiven. PSLF allows students who work in not-for-profit schools, public schools, the Peace Corp, or other public service jobs to have their loans forgiven.

“If you make all of your payments – it’s 120 payments, so every payment for 10 years – any remaining amount on your loans is forgiven if you work in a public service job.If you couple those two together, you can actually end up paying much less than you borrowed. The logic is that you’re paying back to society in other ways,” says Henkel.

Henkel is currently enrolled in the program, and his job at Wofford that qualifies him for PSLF. According to Henkel, the biggest downside to the program is its bureaucracy. Demand is high, but support is low. After first filing for PSLF, he waited eight months before hearing back.

“Let’s beat the people who want to get an education. Those shouldn’t be the people you’re strapping with debt,” says Henkel.