Crippling student and its long-term effects

College is often viewed as the gateway to success and as the most efficient route to achieving the American dream of homeownership, a high-paying job and financial stability. However, in recent years, student debt has cast a shadow over college graduates, causing them to reconsider the price of higher education.

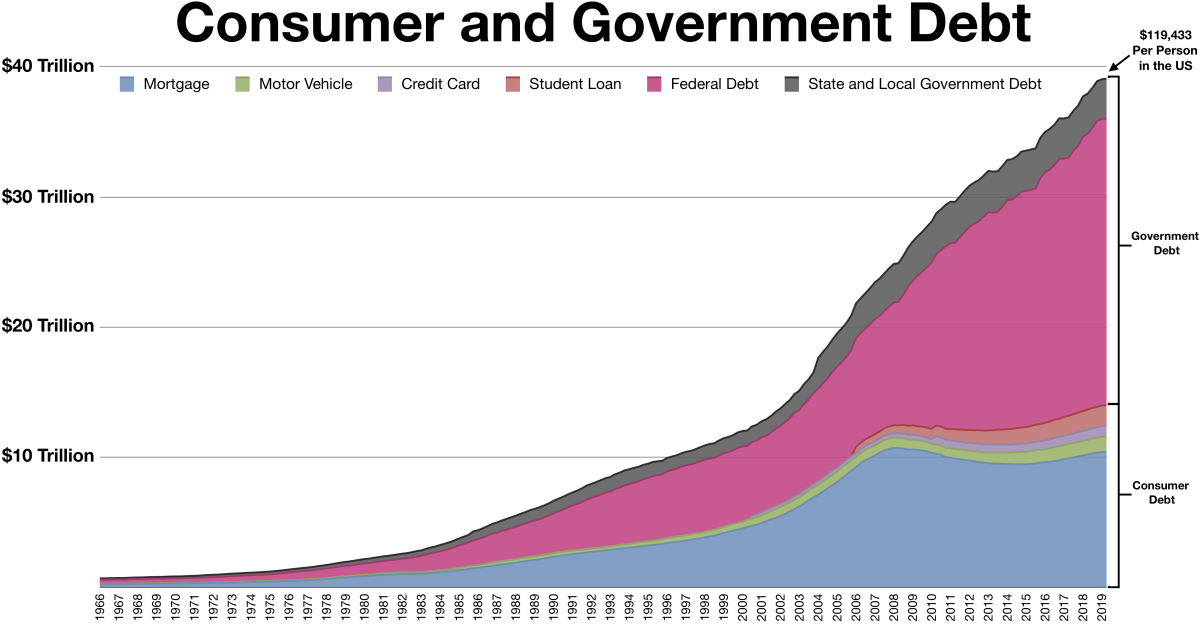

According to the Federal Reserve, national student loan debt reached 1.6 trillion in June 2019, while the average amount of individual debt is nearly $30,000.

College graduates from all walks of life have found themselves delaying milestones of adulthood such as marriage, purchasing a home or vehicle and becoming financially independent from parental figures.

Former college students also battle mental health issues in the forms of anxiety, depression and increased stress due to debt.

A study published in BMJ Journals revealed that some students alter their career paths based on the ratio of debt compared to the income they will be making in order to pay it off within a reasonable amount of time, sacrificing personal aspirations for financial security.

Some skeptics of the American educational system believe that institutions of higher learning perpetuate elitism and wealth inequality by ensnaring students lacking financial literacy into decades-long commitments while then turning them over to society without soft skills such as conflict resolution, time management and communication to operate effectively in the workplace.

Barbara Humpton, CEO of Siemens USA addressed these issues during a press conference at the White House in 2019.

“All too often,” Humpton said, “job requisitions will say they require a four-year degree, when in fact there’s nothing about the job that truly requires a four-year degree — it merely helped our hiring managers sort of weed through the crowd and get a smaller qualified candidate group.”

Other successful proponents of the idea that worth should not be determined by a college degree include Tesla CEO Elon Musk, who does not require employees to have a college degree. Musk regarded universities as “a place to have fun and prove you can do your chores” rather than for learning, expressing the notion that anything can be learned for free with access to the internet and the ability to think divergently.

Defenders of the current economic system maintain that college is an investment worth the cost and that loans make a degree more attainable to low income students. There is also evidence supporting the long-term benefits of earning a college degree.

According to The Social Security Administration, men with Bachelor’s degrees earn $900,000 more in median lifetime earnings than high school graduates, while women with Bachelor’s degrees earn $630,000 more. Individuals with graduate degrees fared the best, accruing over 1.1 million in earnings over the span of their careers.

A few months ago, President Joe Biden unveiled a strategy to alleviate college debt and increase the equity of higher education.

“Public colleges and universities are going to be tuition free for families earning less than $125,000,” Biden said in an address. “If you make more than that, you will only have to pay a small percentage of your income in order to be able to pay off your debt.”

Biden also said that it is “only right” that the United States wipe out student debt for people who choose to go into public service occupations like teaching or counseling victims of domestic violence.

Doubters of this plan have raised concerns about increased taxes in a tuition free world, creating a greater economic burden for the American people to bear, as the finances for college must stem from a source and no solution comes without caveats.

Some economists pushed back against the idea of free tuition by stating that it primarily serves public schools, potentially causing a decrease in enrollment at private liberal arts colleges, leaving smaller institutions at a disadvantage and detracting from the diversity of attendance choices in higher education.

Biden concluded his address by alluding to the idea that education is a pillar of American life and should be safeguarded as a right for all who desire it rather than a privilege.

“We can achieve all these critical things,” Biden said. “Education isn’t just what we do as a nation, it’s who we are.”

Written by Nehmiah Broadie